Introduction

The Bangladesh poultry industry primarily produces chicken although a few other species like duck, pigeon, quail, goose, turkey, and guinea fowl are available throughout the year. Chicken meat and eggs are, so far, the cheapest source of animal protein in Bangladesh and it is well

accepted by all religious, economic, social, and demographic groups (Simon, 2009). Poultry meat and eggs available in Bangladesh are mostly originated from locally grown backyard poultry and also from small and large scale poultry enterprises. Meeting the domestic demand for meat and eggs through importation is very rare and sporadic (Anas, 2015). Before industrialization, backyard poultry was the sole source of local, low-productive, and non-descript chickens in Bangladesh and it primarily met the demand of the producer’s family consumption (Ahmed and Islam, 1985). Over the course of time, industrial poultry has occupied major shares in the total supply of poultry meat and eggs as the industry adopts modern breeds/varieties/strains, sophisticated housing and equipment, and efficient marketing systems. Government efforts, the involvement of some NGOs and scholastic entrepreneurs, and changes in the socioeconomic status of the country over the most recent two to three decades has favoured this greater shift in the Bangladeshi poultry sector (Raha, 2013).

Changes in the poultry industry started in 1934 with the introduction of improved breeds through government initiatives. Then, it was slowly continued until 1960 with the crossbreeding between local and exotic poultry stocks. Between 1960 to the 1980s, commercial farms like “Eggs & Hens” and “Biman Poultry Complex” were established (Kabir, 2005). Before 2000, all the commercial broiler and layer farms were dependent on imported parent stocks, but with the beginning of the new millennium, many local and multinational giant producers started their parent and grandparent stock operation locally to meet the country’s demand. Currently, the poultry industry in Bangladesh is proud to have world-renowned broiler and layer strains ranging from grandparents’ stock to commercial hybrids. The most commonly available broiler strains in Bangladesh are Cobb 500, Ross 308, Indian River Meat, Tiger Sasso, Habbard, and Arber acre; whereas the most reared layer strains are Novogen Brown/White, Hyline Brown/White, Shaver 579, ISA Brown, Hi-Sex Brown/White, and Bovine White.

Along with transformations in the industrial poultry sector, a great change has also been happening in Bangladesh’s backyards. Backyard chicken farms are now comprised of high yielding breeds and crossbreds like White Leghorn, RIR, Fayoumi, Sonali, and Rupali along with the indigenous nondescript individuals. The shares of industrial and backyard poultry sectors in Bangladesh are approximately 50 : 50 for egg production and 60 : 40 for meat production. The backyard chicken farming sector is transitioning from family poultry production towards becoming a mini- industry involving more capital, more job opportunities, and more productivity and profitability (Huque et al., 2011).

A revolutionary change has been happening in the total input-output sectors of the industrial poultry along with a shift in chicken genotypes and production systems in the country. For example, a majority of the chicken population in Bangladesh are now under an integrated production system rather than a single unit of production. Therefore, the amount of invested capital, production volume, total turn-over rate, and total business risks have also become greater nowadays than those of the 1980s. The share of imported machineries, equipment, feed, vaccines, and medicines for the poultry sector in Bangladesh is decreasing day by day due to a huge development in backward linkages.

The larger input and output sectors in poultry have been supported by the socioeconomic status of the country. A higher purchasing power of the people and a more positive attitude towards fulfilment of nutritional requirements has undoubtedly facilitated this great revolution in the poultry sector. The increasing number of health conscious and educated people in this society, coupled with a robust purchasing power and strong government monitoring system, could work towards a greater force to support the new expansion of this sector in the near future. Hence, it may be hypothesized that the poultry industry in Bangladesh is now entering into a new phase. And, in that phase we ask ourselves, what type of products, production and marketing systems, and public-private dealings might be needed to help the existing investors, new entrepreneurs, and forward and backward linkages of the poultry sector in Bangladesh.

Current Status of the Poultry Industry in Bangladesh

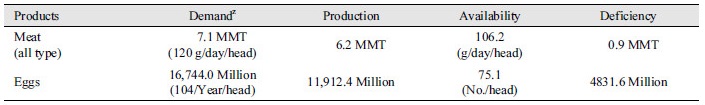

In recent years, the poultry sector in Bangladesh has gained sufficiency against the current market demand (Raha, 2013), but not against the standard nutritional requirement (DLS, 2016). Starting from the 1980s the industrial poultry sector gained massive momentum towards the industrial phase. After that, it gained a significant annual average growth rate, approximately 15 - 20% annually, until the outbreak of avian flu in 2007. After 2015, this industry again attained the capacity to fulfil the domestic demand for broiler, edible eggs, parent stocks, and precooked poultry products. Table 1 presents demand, production, availability, and deficiency of meat and eggs in years 2015 and 2016. It shows that production of meat and egg was found to be lacking 0.9 million metric ton (MMT) and 4,831.6 million. Below is the summary of the current status of the Bangladeshi poultry sector (Khaled, 2015; DLS, 2016), Poultry Kamar Bichitra (PKB) (2016) and Personal communication with the stakeholders:

- No. of GP farms in operation: 07

- Production of parent stock per week: 60,000 - 70,000

- No. of listed breeder farms: 140

- Production of DOC: 11.9 million/week

- No. registered of feed mills: 120

- Production of industrial feeds: 3.05 million tons

- No. of commercial farms: 60,000 - 65,000

- Production of commercial layer eggs: 32 million/day

- Per capita broiler meat consumption is 3.74 kg

- Share of broiler meat out of total meat consumption: 54%

- In 2020, per capita poultry meat consumption expected to be reached is 8.42 kg

- In 2020, the expected contribution of poultry meat could increase to 78%

- Contribution of poultry sector to the GDP: Approximately 1%

- Total capital involved in this sector: 5,000 crore

- Direct and indirect employment: 2 million people

- By the year 2020, the poultry sector is expected to employ 11.2 million people or 2 million new households.

Changes in Various Parameters of Bangladeshi Poultry Sector Over Time

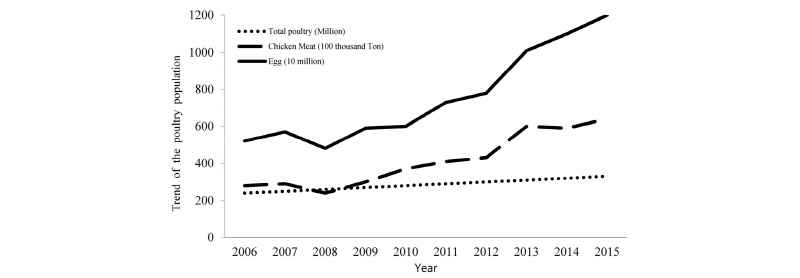

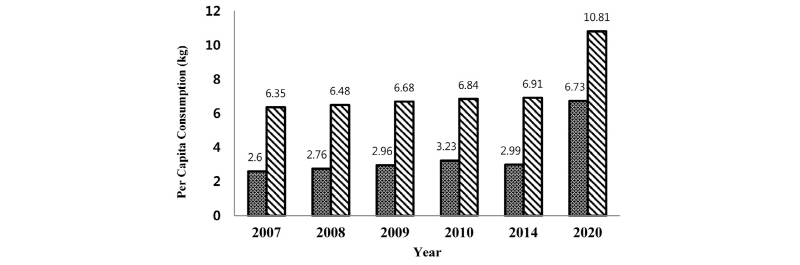

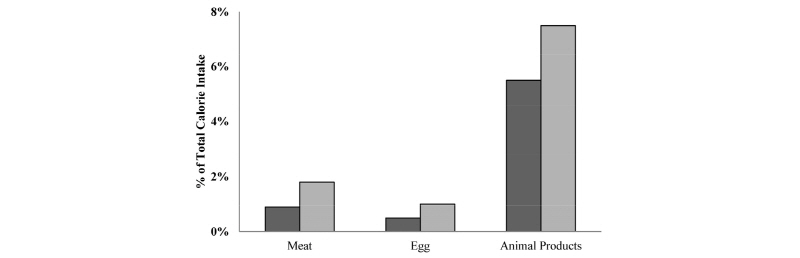

The poultry population and volume of poultry products are increasing in Bangladesh. Fig. 1 shows the trends of poultry population and product dynamics in Bangladesh in the last decade. The data presented in Fig. 1 reveals that the meat and egg production efficiency has been increasing over time. The phenomena might be the result of the introduction of high yielding breeds and the variety of chicken strains developed over time in both backyard and commercial farms. A decade ago, the largest farm in the country produced up to 50,000 eggs per day or 10,000 broilers per week. But, today, they produce 50,000 eggs per day or 100,000 broilers per week. However, per capita consumption of meat and eggs in Bangladesh is still low compared to that in neighboring countries. On average, one person in Bangladesh consumes 3.2 kg of meat and 75 eggs per year, compared to 38 kg of meat and 320 eggs in Malaysia. Fig. 2 shows the per capita consumption and projected demand of animal proteins. The projected demand for poultry products is increasing day by day and it is expected to double by 2020 from the demand in 2007.

Some Inevitable Changes that are Approaching for the Poultry Sectors

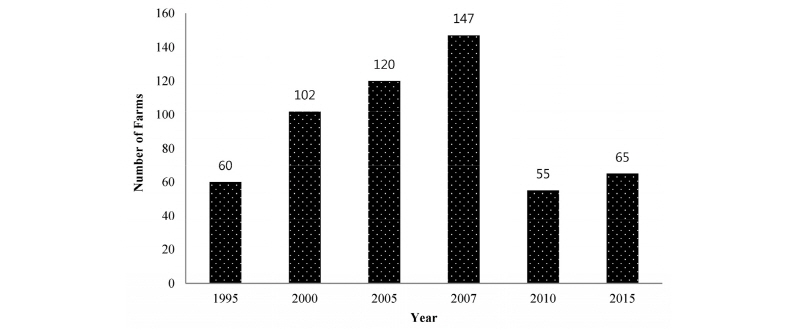

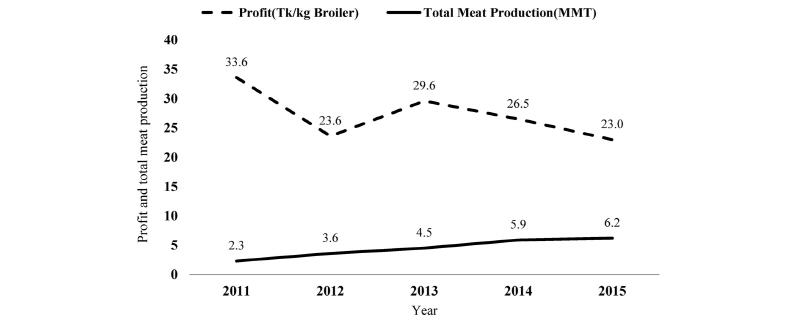

The remarkable changes currently happening in different areas of the Bangladeshi poultry sector are as follows: i) the total number of farms; ii) the net profit against production volume; iii) the strength of local production of parent stock and hybrid day-old-chick (DOC); iv) the entry of large farms into vertical operations; v) the full control on chick and broiler prices and vi) the expansion of dressed and further processed chicken industries. A critical analysis shows that the number of commercial farms fell sharply after 2007 and is not returning to pre-2007 numbers and that it will likely remain relatively constant for the near future (Fig. 3). Another remarkable change observed in the analysis is that the profit margin is becoming narrower along with a higher volume of production (Fig. 4).

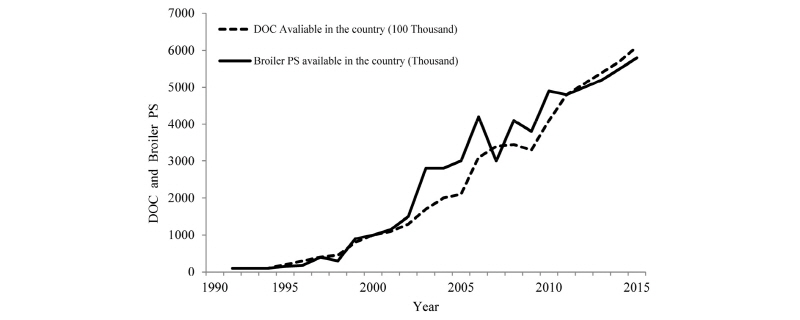

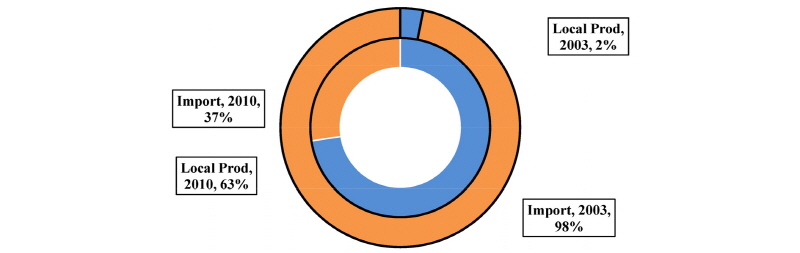

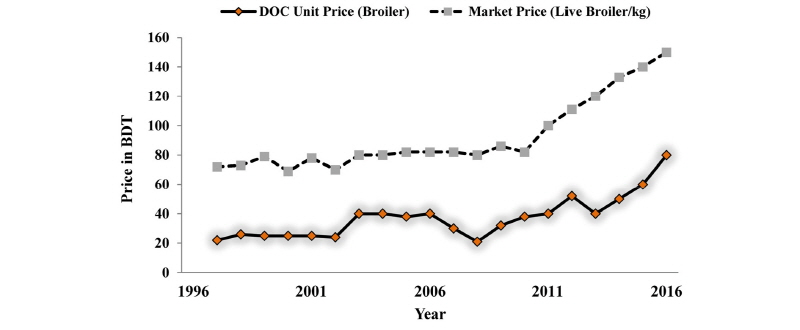

Another easily sensed change that has happened is the ownership of parents’ stock and own production of DOC by the country. Actually, an uninterrupted local supply is a pre-requisite for the stability of the poultry sector. If both the parent stock and commercial DOC are produced locally at optimal numbers, the price fluctuation of DOC and meat could become minimal. This trend has clearly been shown in Bangladesh’s poultry sector (Fig. 5, 6, and 7). Figure 6 shows that a major portion of the parent stock has been produced in Bangladesh since 2010. The DOC and market broiler prices seem to be constantly increasing without significant fluctuation for the last 5 years since 2010 (Fig. 7). The constantly higher prices of DOC and broilers might be the effect of global increases in feed and equipment prices and inflation.

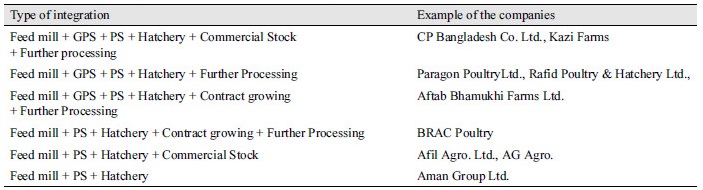

A number of giant poultry companies have already integrated their operations. Table 2 presents the list of companies and the nature of their integration. The local frozen food market is also growing, at a rate of almost 30% in 2011 - 12 over the preceding year. Its projected market value in 2013 was BDT 3,400 million plus (LCB; Light Castle Blog, 2015). Poultry and meat processing is a very recent addition to the food processing industry in Bangladesh. Several integrated poultry companies have joined this sector recently, but only one modern beef processing facility and ten poultry processing facilities are currently in operation. The processed meat account for less than one percent of total meat production.

Table 2. The list of companies and the nature of their integration.

|

|

|

GPS = Grandparent stock and PS = Parent stock (Information collected from online sources and personal contacts. |

|

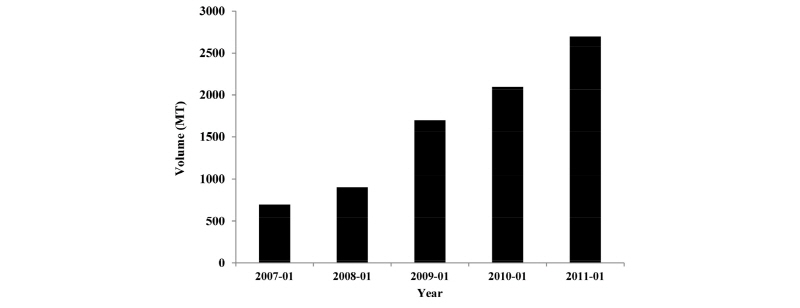

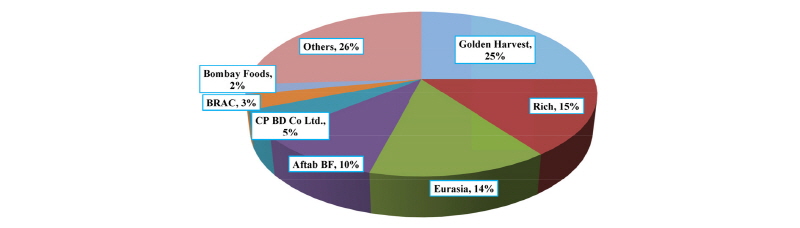

Frozen chickens are mostly available through high-end super stores charging premium prices but this market is increasing every year (Fig. 8). Another market segment is catering to the major fast food chains. BRAC Poultry is one of the major players processing 10,000 chickens per day and supplying to major fast-food giants including KFC, BFC, and CFC (LCB, 2015). Other major players are CP BD Co. Ltd., Bombay foods, Rich, Eurasia, and Aftab Bhamukhi Farm (Fig. 9).

Some Influential Factors that Support the Changes in Poultry Sectors

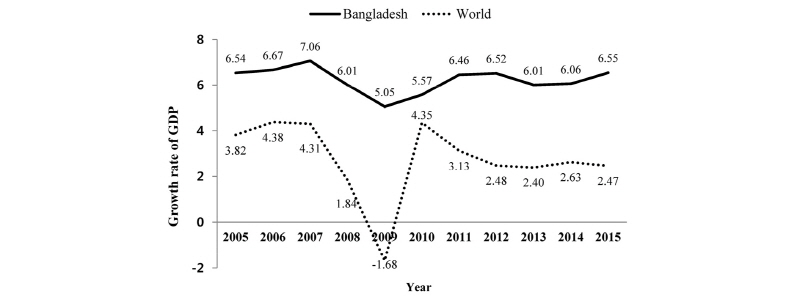

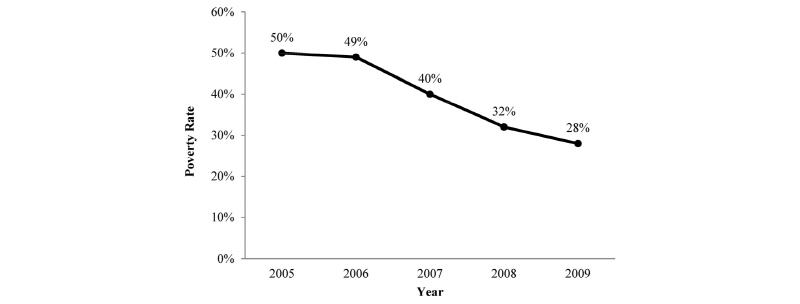

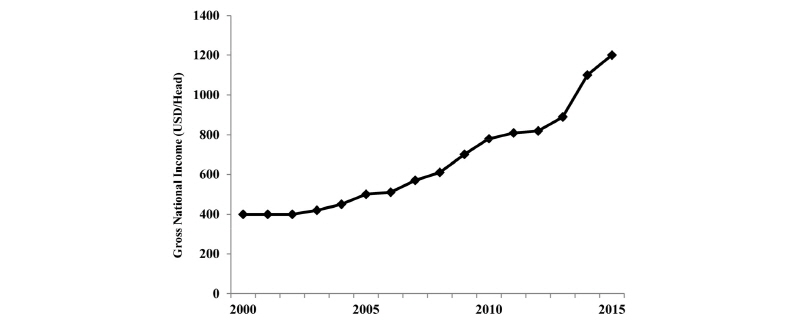

The most significant factors supporting the transformation in Bangladeshi poultry sectors are the increasing trend of gross domestic products (GDP) and gross national income (GNI), the increase of per capita animal protein consumption, and the replacement of the low-income group with a middle-class population (Fig. 10 - 13). There is no doubt that this higher purchasing power is key to an improved lifestyle and processed food consumption. The higher GNI, in fact, facilitates a better lifestyle for the Bangladeshi people on one hand but forces them to consume ready-made food on the other hand, by making consumers busy in such a way that they do not have time to work at home (Anas, 2015; Sohel, 2016).

Bangladeshi Poultry Sector is Entering Into a Multi-dimensional Stable Phase

A mature and fully developed poultry industry tends to be characterized by high volumes with low margins as it must compensate for the low margins at each stage of production. Vertical integration has strengthened the large farms, increased their profit constantly, and increased their capacity for diversifying their losses, if any (Sohel, 2016). Projected increased demand for chicken meat and eggs, along with the reduced number of commercial farms, has given the large farms inspiration to make their operation even larger under a minimally competitive environment. Furthermore, the entry of the larger farms into the rapidly growing processing industry has opened their eyes to making the poultry business more stable under a complete “Farm to Fork” integration system.

Conclusion

The overall facts and figures presented in the article clearly indicate that the Bangladeshi poultry sector is entering a new phase where large integrators will be the key players. The easiest scenario to envision for the future of the poultry industry involves minimal fluctuations in supply and pricing long with the dropping-out of small scale commercial farmers and backyard farmers. Change in lifestyles and an increase of the country’s middle-income group with higher per-capita GNI and GDP, might help a smooth transformation in the poultry sector of Bangladesh with minimal hassles. However, increased investments by both the public and private sectors in sustainable and affordable electric power would be required as it is one of the perennial constraints to Bangladesh's industrial growth. Cross boundary market competition, global poultry feed availability and pricing, and emerging diseases might be other possible constraints to this potential transformation. Providing incentives for the use of poultry waste for biogas production would help ameliorate the power shortfall while offering an environmentally-friendly method of waste management. The drawbacks that might arise from the speculated transformation are the monopoly by the large industries and higher pricing of the products that would go beyond the control of the government. Hence, to make these poultry sector transitions more balanced, the government and private sectors should start planning right now on how the necessary activities would go together.

Furthermore, Bangladesh is showing an increase of egg and chicken consumption each year and the livestock industry has the highest growth potential in the country. In particular, the poultry industry can become a new income source for the people of the rural agriculture areas of Bangladesh since it requires little capital investment and has a short turnover period for investment funds. It can also make significant contributions to the economic vitalization of these agricultural regions.

In the future, there is a need to promote the cooperative studies, field dispersion projects in particular, with Korea for improving the productivity of poultry which will enable the expansion of this industry. Cooperative projects may bring about innovative solutions to productivity improvements, such as the reduction of fatality rates, improvement in weight gain, and so forth. More importantly, international cooperation can help establish production systems for low cost chicken which saves on feed expenses for improvement of the profitability through cost savings at the farm level. Therefore, new cooperative projects, giving rise to independent feed and chicken production systems through farm organizations, should be developed. Furthermore, as the use of antibiotics is increasing as livestock numbers are scaled up, the development and use of probiotics will be necessary for the safety of consumers (Kim et al., 2016). It is necessary to develop agriculture in relation to regional development (Yu et al., 2016).